Whales matter, in business, and for just about every business, including the mobility business, which might seem the poster child for a business model founded on scores of millions to hundreds of millions of small accounts. But some mobile accounts are more profitable than others.

source: Reforge

For example, the lifetime value of a long-time account is far higher than that of an account with a lifecycle of three years.

Look at expected profit contributions across a firm’s customer base. The first 20 percent of customers will supply the most cumulative profit. The tail of the last 80 percent of customers might contribute almost nothing in that regard.

In the mobile business even consumer accounts are much more profitable based simply on account longevity.

source: Baker Tilly

How can a software startup better estimate where its revenue might come from? Nnamdi Iregbulem, Partner at Lightspeed Venture Partners, actually has thought quite a lot about that subject. Basically, it appears the Pareto Principle holds for software startups, across the full range of firm sizes.

“I think people talk about concentration as if there are a couple of companies that have revenue concentration issues, and then the rest are fine,” says Iregbulem. “ It just turned out that literally every company has pretty high customer concentration, not in the sense that there was one customer that was 10 percent of revenue, but in the sense that there was a subset of customers that were a pretty meaningful share, something like 20 percent being 70 percent of revenue.”

source: Nnamdi Regbulem

In other words, in every industry segment, it is not just “whales” who see Pareto distributions, but firms of every size in every segment. The implications are clear enough: even a smaller firm targeting a smallish niche is going to have its own “whales” (a few customers than anchor total revenues). The same goes for profits.

source: Baker Tilly

“It’s a very common mistake I find among investors where they'll meet a company, the company will have X number of customers and the standard ACV (average contract value) will be fairly small because most of their users are either free users or in some kind of lowest-tier version of the product,” says Iregbulem. “But they do have a couple of meaningful customers that are spending real revenue or paying the highest tier of a product or what have you.”

It is not unusual for as much as 60 percent of customers to provide no more than “breakeven” performance, in terms of profitability.

source: Baker Tilly

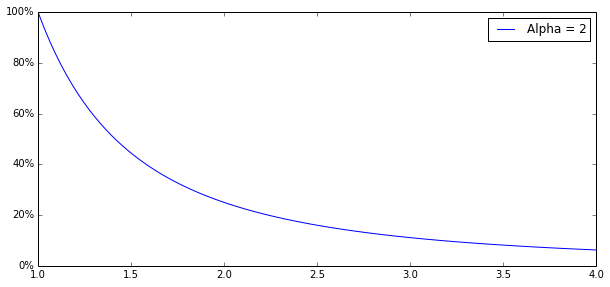

In other words, software monetization is a power law. A power law distribution is a curve that looks like this: most of the results are generated by a small fraction of instances, products or customers. “Rather than the exception, high concentration is the norm in certain verticals (for example cloud infrastructure) or pricing models (consumption/pay-as-you-go) where a "customer" can be as small as tens of dollars per month,” he notes.

source: Reaction Wheel

In the data center and connectivity businesses, that rule tends to hold as well. A handful of customers anchor demand for global bandwidth and data center capacity. The rule also seems for devices connected to Wi-Fi.

“Combined, the above insights form a mathematical justification for "land and expand"-style go-to-market strategies,” he adds. “Here, land and expand is effectively an indexing strategy: land at as many organizations with as little investment as possible.”

“Every once in a while you'll land a Google, a Facebook, or an Amazon (both figuratively and literally) which will drive a disproportionate share of revenue,” he says.”Even if those customers start off small, any given customer could potentially become quite large.”

Whales matter, in business, for revenues and profits.