There are just a few fundamental ways to increase wireless capacity: reduce the size of cells; allocate additional spectrum or share spectrum. All three are features of present next-generation network architectures.

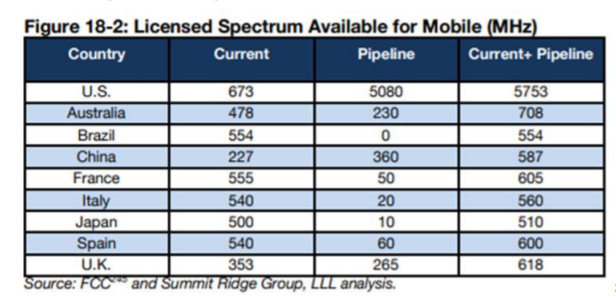

In the U.S. market, for example, already-planned moves will increase mobile operator spectrum by an order of magnitude.

source: Summit Ridge Group

The movement to small cells is partly a result of physics, partly economics and partly a matter of government policy and enterprise choices. As wireless and mobile communications move to higher frequencies, coverage areas decrease. That forces the use of smaller cell sites.

Economics plays a role as well, since outdoor cell sites using millimeter wave frequencies will not be able to reach inside buildings. Government policy plays a role by authoring the use of spectrum for both licensed, shared and unlicensed uses by private network operators. Enterprises also make choices to build and use private networks using 4G or 5G platforms.

source: Commerce Spectrum Management Advisory Committee

Along the way, we are redefining our notions of frequency bands, as we have periodically revised our definitions of “broadband.” In pre-internet days, the formal definition of “broadband” was any data rate of 1.544 Mbps or higher. These days we routinely change the functional definition, with some minimum definitions based on the 25 Mbps downstream capability.

As a practical matter, fixed network access speeds can routinely run between 100 Mbps to 200 Mbps. In September 2020, for example, U.S. typical fixed network speeds were 161 Mbps and mobile access speeds averaged 47 Mbps. Typical fixed network speeds in Singapore that same month were 227 Mbps, about 210 Mbps in Hong Kong, 175 Mbps in Thailand and 173 Mbps in France, for example. In each case, half of actual experienced speeds were higher than average, while half were lower than average.

source: U.S. White House

Spectrum sharing is the latest tool used to increase wireless network bandwidth, both mobile and fixed; licensed and unlicensed.

In addition to 4G and 5G spectrum sharing, where a mobile operator can use both 4G and 5G capacity to support devices and users, spectrum sharing allows new users to operate in licensed bands held by others and supports use of both licensed and unlicensed spectrum by mobile devices and users.

In essence, spectrum sharing is part of a broader move to virtualize network and computing operations, as can be seen in cloud computing, network functions virtualization and software defined networks. All those instances create independence between network elements or devices and the software and computing functions used by those machines.

Spectrum sharing matters because spectrum is a scarce asset, because capacity demand is growing very fast, because shared spectrum reduces the cost of using spectrum and also increases the effective supply of capacity, faster than would be possible if airwaves were repurposed and existing users moved to new bands.

It has been estimated that the value of licensed U.S. mobile spectrum is $500 billion, for example. Likewise, it has been estimated that the value of U.S. Wi-Fi spectrum alone represents $140 billion in value.

To be sure, spectrum sharing also introduces a new element of business model uncertainty, because spectrum sharing can replace a large measure of scarcity with a large measure of abundance.

And abundance means lower value for licensed spectrum, even as it increases the range of sustainable business models that can be built on spectrum.

Nearly all of the most-useful communications spectrum already has been allocated, and much spectrum is inefficiently used. Today, the U.S. government, for example, possesses almost 60 percent of radio spectrum and possesses over half—1500 MHz—of the valuable 300 MHz to 3 GHz spectrum useful for terrestrial wireless and mobile communications.

Much of that spectrum is lightly used or even not used. At a time when most observers believe people, organizations and businesses will need vastly more Internet and communications capacity, that is a waste of scarce resources. Spectrum sharing increasingly is seen a way to protect legacy users but make more efficient use of radio frequency resources.

Spectrum sharing now is practical because we are able to apply cheap and sophisticated signal processing to communications tasks. As a result, virtually all communications spectrum can be used more efficiently and effectively.

Cheap and sophisticated signal processing allows commercial use of millimeter wave spectrum (3 GHz to 300 GHz) for the first time. The same advances allow us to use existing spectrum more efficiently, moving beyond simple frequency or spatial separation.

Those methods work, but also create fallow resources. Since nobody but the licensee can use the capacity, when the licensee is not using spectrum, nobody else can use it, either. In some cases, as in the United Kingdom and United States, as little as 10 percent of spectrum gets used. In other cases, none of the capacity is used.

Two fundamental approaches now are feasible to allow many users to share capacity without causing interference to existing licensed users, but also vastly expanding the amount of capacity available to support communications and apps.

Devices themselves, or databases, are able to sense or predict where interference would occur, and then shift access operations to non-interfering frequencies or channels. Cognitive radio is an example of the former approach; databases an example of the latter approach.

Spectrum sharing is the simultaneous usage of a specific radio frequency band in a specific geographical area by a number of independent entities. Simply, it is the “cooperative use of common spectrum” by multiple users.

Spectrum sharing also can take many forms, coordinated and uncoordinated. Coordinated forms include:

TV white spaces (database determines what you may use, when and where)

spatial sharing between business entities (you use here, I use there)

priority sharing between entities (I have first rights, you have secondary rights) Licensed shared access or authorized shared access are examples

license assisted access (bonding of mobile and Wi-Fi assets)

cognitive radio (devices determine how to avoid interference)

Uncoordinated forms of access historically is best illustrated by Wi-Fi.

The arguably more important forms of spectrum sharing use new technology to intensify the use of existing spectrum, such as licensed shared access (LSA) that allows many users to share a specific block of spectrum.

The concept is to free up capacity quickly by allowing commercial users access to currently-licensed spectrum on a secondary basis, while licensed users continue to retain priority use of their spectrum.

The advantage is that such sharing avoids the huge time and expense of relocating existing users so other users can move in.

Under the licensed shared access approach, additional users can use the spectrum (or part of the spectrum) in accordance with sharing rules that protect incumbents.

Spectrum sharing directly affects the future of telecommunications and all businesses built on the use of wireless communications. Spectrum sharing also indirectly affects all other potential alternative means of communications.