Vanishing boundaries between content network and distributor functions are the best examples of how access providers can “move up the stack” to create value, but also now illustrates how the distribution function--essentially “moving down the stack”--have become important strategic realities in the communications business.

For decades, access providers have worked to add more value by moving into the applications or platform segments of the ecosystem. Essentially, those efforts are a reprise of the original state of affairs, when telcos created and owned the only applications that mattered on such networks.

In other words, voice and messaging were apps fully created and owned by the service providers. In the internet era, all that changes, as application creation and ownership is logically separated from the “network access” that allows people to use those apps.

In a real sense, shifts in the video entertainment business offer a successful example of how access providers can move up the stack.

In the past, some companies or people developed and created content; others bundled it (networks) while other firms distributed the content (TV stations, cable TV companies). In other words, the content business separated delivery from content creation and ownership.

The big distinctions, maintained in law, were that entities involved in one part of the ecosystem could not also be owners of assets in other parts of the ecosystem. So movie studios were barred from being theater owners and big networks could not own large shares of the distribution market (networks owning local broadcast outlets).

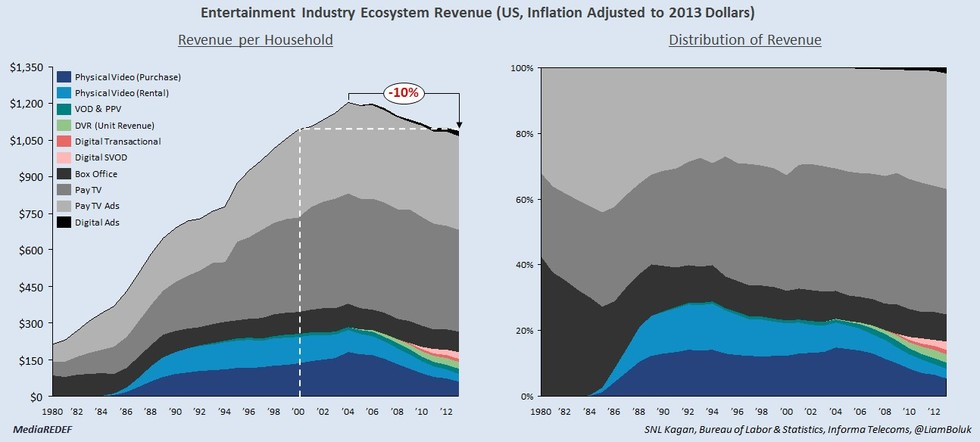

Over time, some of those restrictions have been eased. And though ecosystem includes both retail subscriptions, advertising, on-demand content purchases (including movie theater tickets, home video). For the most part, advertising and subscriptions drive distributor revenues, while content licenses and advertising drive bundler revenues. Content creator revenue is generated primarily by sales of intellectual property.

The continuing debate within the ecosystem is the relative balance of value and therefore power between content bundlers (networks) and distributors (primarily video subscription providers, both linear and on-demand).

That debate is becoming less relevant as strategy now pushes each of the formerly-separate industries to integrate the functions. In other words, content networks become distributors, while distributors become content networks.

Traditionally, the issue was whether the content bundlers (networks) or the distributors (cable TV, other providers) had more power within the ecosystem.

The new change is that “distribution” itself has changed, from those with actual physical networks, and those distributing “over the top” (Netflix, Hulu, Amazon Prime). These days, some distributors own and operate physical access networks, while others do not.

In fact, the line between “networks” and “distributors” is blurring. Netflix aims to increase the percentage of “owned” versus “licensed” content to 50 percent. In other words, Netflix plans to become as much a network, with original programming, as a distributor.

Disney, on the other hand, owns 75 percent of BAMTech, a platform for streaming video distribution. That, plus its announced intention to create its own streaming service means Disney also will become a distributor.

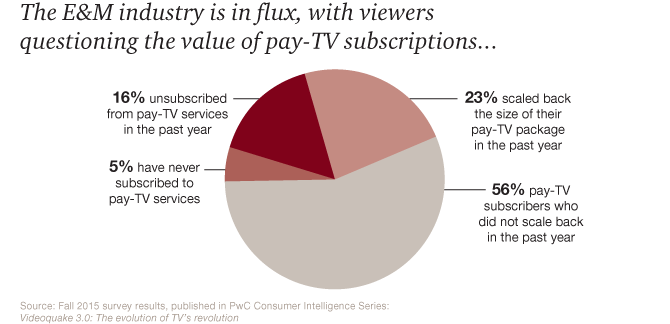

In fact, market share within the “distribution” segment itself is changing, as fewer customers buy “big bundle” subscriptions, while more embrace streaming services of various types. As Netflix shows, the emerging model might well be networks that also are distributors, bypassing or augmenting many other existing distribution vehicles.

The larger point is that the drive to move “up the stack” or “down the stack” will continue.

Google, Facebook and Amazon have moved “down the stack” into access services of various types, and are working on other initiatives to support such moves. Comcast and AT&T have moved up the stack into network ownership.

That will be the model for internet of things services and apps as well.

No comments:

Post a Comment