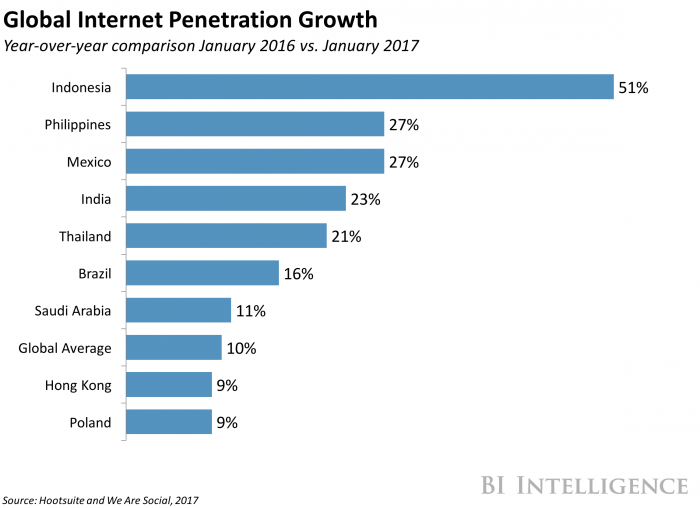

After launching its “Google Station” program in India, supplying Wi-Fi to train stations, Google is doing the same in Indonesia. Google is partnering with internet service providers, venue owners, and system integrators in Indonesia to provide consumers with free access to Wi-Fi at railway stations, universities, and other public areas.

source: Business Insider

source: Business Insider

In one sense, Google Station is simply a way Google can increase the potential number of its users in India and Indonesia, the same reason Facebook is sponsoring Wi-Fi access efforts in a number of countries. Without internet access and smartphones or other devices, people cannot use Facebook, Google or other apps.

In 2016, on average, consumers in India used 15 times more data each day on Google’s Wi-Fi network than they did on their mobile networks.

Offering high-speed data for free could mean new users associate Google with fast internet. Each day, around 15,000 people use one of these stations in India to connect to the internet for the first time, Google says.

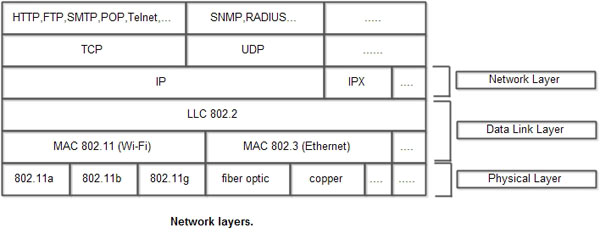

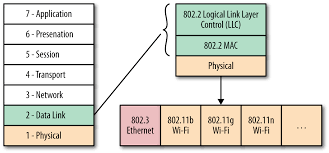

That trend also points to another change, though, namely the emergence of Wi-Fi as the physical layer “access” method, where historically it has been telco or other networks that have provided that function. That is not to say the access and core networks are unimportant; they remain essential.

But the end user experience now often substitutes Wi-Fi (classically an in-building distribution network, not the means of network access) for a traditional fixed or mobile internet connection. In principle, that changes the value proposition for access suppliers, changes the end user relationship and the potential business models for access services.

For the most part, Wi-Fi is a function, not a direct revenue stream. That is why one rarely sees, or cares (with the exception of Wi-Fi hotspot service providers), what “Wi-Fi service revenue” happens to be. Usage matters, but “direct revenue” is nil. Wi-Fi is an amenity or an indoor distribution network, not a direct revenue stream.

That raises one thorny issue. To the extent that Wi-Fi “gives away for free” what some service providers sell (that is a fraction of use cases), it puts pressure on the “value” of internet access services.

And that is the long-term strategic problem, irrespective of the immediate potential revenue losses. Consumers might start to expect “no extra charge” Wi-Fi to be a nearly-ubiquitous access method, when out of their homes.

While they might expect to buy at-home internet access (fixed or mobile), consumers increasingly understand that when “out and about,” Wi-Fi at no extra charge is going to be available. That “relegates” mobile network access to the truly-mobile use cases, as Wi-Fi is presumed to be the default access when users are stationary or indoors.

Though complicated, growing use of Wi-Fi might complement access provider revenues or compete. Comcast uses its extensive homespot network to drive perceived value for its fixed network internet access service. In other cases, use of Wi-Fi allows consumers to spend less on their mobile data plans, and so arguably reduces service provider revenue.

In other cases, Wi-Fi is simply the in-building distribution network, and does not directly affect access provider revenues at all.

In yet other cases, Wi-Fi supplied by third parties allows other access providers to operate with lower capital investment, as demand is shifted to the Wi-Fi network.

On the other hand, use of Wi-Fi as a primary form of mobile device access also destroys some portion of the potential access provider market, namely the ability to monetize usage.

Strategically, that is the greatest danger Wi-Fi poses to access providers: it strikes at the ability to earn money for access services; reduces revenue per account and perceived value of such access connections.

No comments:

Post a Comment