Some business problems appear to be theoretical (“someday our business will have to change”); other times clear problems, but to be left the next generation of leaders (“I will retire in two years, those problems will be severe only after that”); in some cases clear and immediate realities (“core revenue already is declining, we need to reignite growth”).

In the telecom business, the need to find new sources of revenue growth arguably is clearest in Western Europe, North America and parts of East Asia, but not an immediate problem in much of Asia or Africa.

For the most part, mobile service providers in much of Asia can afford to take a longer view, as subscriber growth is not yet exhausted; while mobile internet growth is in early stages. Both those sources of growth remain intact for much of Asia, though not in some countries such as South Korea, Japan, Taiwan, Hong Kong or Singapore.

“Companies need to diversify their revenue sources amid sustained declines in the traditional voice telephony and SMS businesses,” Moody’s argues. “We expect companies will continue to expand into digital media, advertising, and mobile payments to future-proof their revenue streams.”

In emerging Asian countries, excluding India, Moody's expects revenue growth of about 3.5 percent in 2018, lower than the forecast gross domestic product growth of about 5.8 percent.

Revenue growth in developed markets will remain in line with expected GDP growth of around 1.5 percent.

The average profit margin (EBITDA) for Moody’s-rated telecommunications companies in Asia Pacific will contract to around 39 percent to 40 percent over the next 12 to 18 months, reflecting intensifying competition, higher costs for providing data services, and investments in margin-dilutive digital businesses, Moody’s predicts.

Meanwhile, the capex-to-revenue ratio will fall to around 25 percent in 2018 from 27 percent in 2016.

India will be the only country where telecom sector's revenue will continue to decline for some time, Moody’s says. "India will be the only country in Asia where industry-wide revenue is declining due to unprecedented price competition spurred by a new entrant.”

All that noted, eventually subscriptions will reach saturation. Eventually, mobile internet revenues likewise will hit a natural limit, as everyone who wants to use mobile service, and every customer who wants mobile internet access, already will be a buyer, and will be paying as much as they can afford to, or want to.

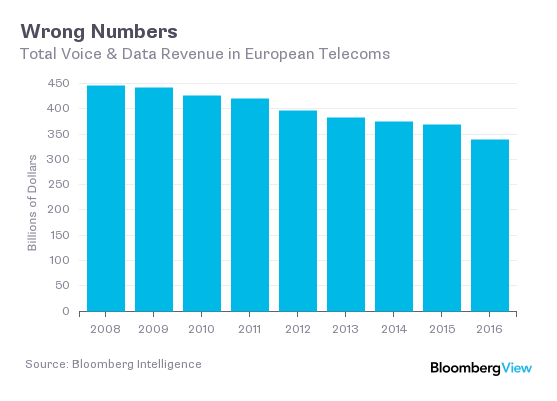

That is pretty much the situation developed market mobile service providers already face. At best, markets are saturated. At worse, revenue already is declining. Asia will not escape that maturation, either. But how soon that saturation is reached remains an issue.

No comments:

Post a Comment