Can you think of a business where the trend is anything other than consumers want anything other than high quality and low price, together? And can you name an industry where suppliers have not, over the last couple of decades, moved to supply that demand?

source: Cowen and Company

source: Cowen and Company

The problem, of course, is that high profits and high gross revenue suffer when that approach has to be taken. Look at the U.S. mobile market, where Verizon long has had a “premium service, premium price” positioning, but faces competitors offering “nearly equal quality, good price” or “good enough quality, lower price.”

At least until something significant changes on the next-generation network and major acquisition fronts, Verizon has a key positioning problem: “high quality and high cost,” while a workable strategy in some markets, for some products, is tough to sustain in mass consumer markets.

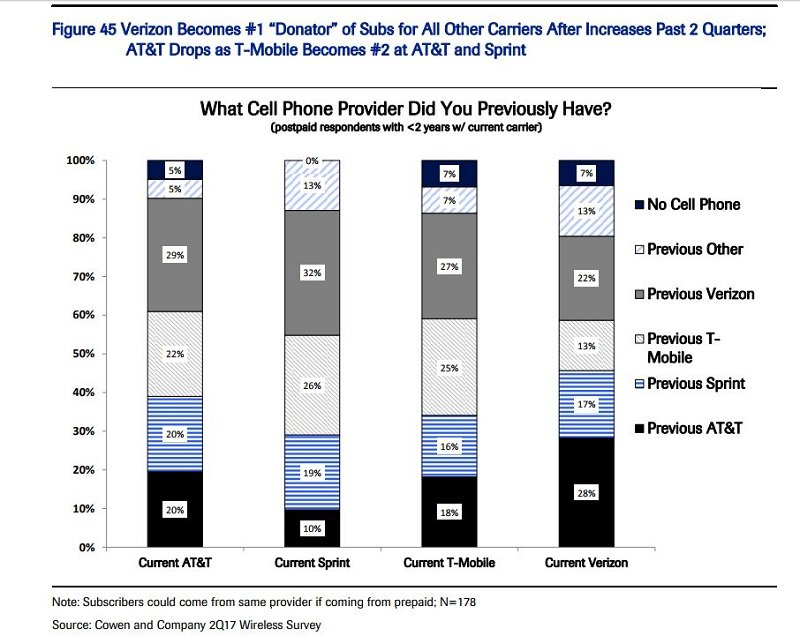

Verizon lost more customers to its competitors than any other major U.S. mobile service provider in the second quarter of 2017, according to Cowen and Company. .

“The results in our view reflect Verizon’s late response to increasing pricing competition and an increasingly difficult-to-justify pricing premium for its promised leadership network experience,” said Colby Synesael, Cowen and Co. equity analyst.

Mobile service providers also serve enterprise and business customers with different buying criteria. And some mobile entities also have corporate parents with fixed network assets that should prove helpful in the 5G era.

And if you assume that virtually all telecom service providers normally have to replace about half their current revenue sources about every decade, there is room to make decisions about the sources of that revenue.

Some service providers might not be able to escape an “access provider only” role. At the moment, that is a workable description of Verizon Wireless, which has almost-negligible revenues from sources not directly related to access (voice, messaging, internet access).

Consider Comcast, which now arguably earns 39 percent of revenue from sources other than its triple-play access services (video subscriptions, voice, internet access).

To be precise, voice and video subscriptions are “apps,” not simple “dumb pipe access.” In a strict sense, voice and video are example of “up the stack” services, where the access provider creates and owns the apps.

The business problem in developed markets is that every such “up the stack” service is declining. So new substitutes, at scale, must be created or discovered. And unless a service provider wants to be a supplier of dumb pipe internet access, that means a search for products with more value, up the stack.

That is why Verizon will move as fast as it can to 5G. Its past experience is that it lead U.S. competitors in mass deployment of fiber to home and 4G, moves that are consistent with its “premium” positioning.

At the same time, 5G will enable many different moves up the stack, because of internet of things. To be sure, there will be “access” opportunities. But the real revenue upside will come from creating platforms at scale, or owning the actual IoT solutions.

That will not, by itself, solve the problem of trying to compete in a mass market with the “high quality, high price” positioning. Verizon’s problem is that such a position arguably is unsustainable. In what area of the mass market does that approach still work well?

No comments:

Post a Comment