“All of the above” is a reasonable way of describing near-term use of spectrum assets for 5G, even if millimeter wave will be important in the future. In the U.S. market, Sprint is focusing on 2.5-GHz spectrum assets, which to this point has been available on perhaps half of Sprint’s towers.

T-Mobile, on the other hand, will rely on its 600-MHz assets to support IoT, advanced 4G and 5G . Verizon will use its 28-GHz licenses for small cell deployments. AT&T will use 24 GHz.

In many other markets, the strategy effectively will be to stick with 4G as long as possible, no matter what is said about moving to 5G.

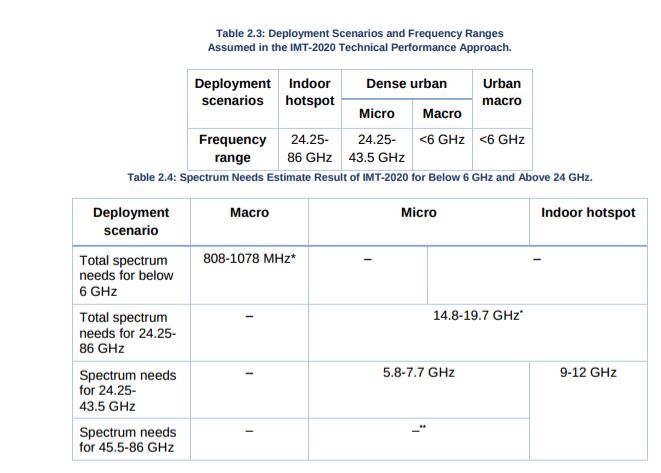

And no analysis will always be correct in any particular locality. According to the International Telecommunications Union, for example, spectrum below 5 GHz is part of the global IMT-2020 “coverage” use case, while millimeter wave is seen as a “capacity” solution.

Unlicensed spectrum also is going to be important.

The point is that 5G will be unlike earlier mobile next generation networks in its very wide use of many frequencies and spectrum bands, compared to earlier generations.

No comments:

Post a Comment